Lately I’ve been doing a lot of my favorite activity: sitting on my couch and watching documentaries on Netflix. One of the recent suggestions that came up was the documentary produced by former US Secretary of Labor under Bill Clinton, Robert Reich, called “Inequality for All.” In this film, Reich presents a compelling case that economic inequality has been the cause of two major economic crises in American history, the Great Depression of the early 1930s and the Great Recession which began in 2008 and which many in the US are still living through.

While Reich is speaking with the best of intentions, I believe his argument suffers from one of the most common logical fallacies: confusing cause and effect. This fallacy is especially pernicious because it systematically keeps us from asking important questions about how our economy is organized.

In this post, I use some concepts from Marxian political economy to illustrate how Reich and other post-Keynesian economists are unable to grasp capital flows, accumulation over time, and class exploitation in their models of economic crisis. In a follow-up post, I hope to discuss the implications of this insight for what economists call “policy.” I am not an economist, but I am an avid reader of Marx, and it seems to me that a lot of the debates economists are having are missing some fundamental insights that Marx can bring to the table.

Inequality and Crisis

Reich is not alone in his belief that inequality was a major contributor to the Great Recession. Indeed, this is quite a mainstream position among economists, and not just those with Marxian or post-Keynesian inclinations. Nobel Prize-winner Joseph Stiglitz (with his The Price of Inequality), along with the head of the central bank of India Raghuram Rajan (with his Fault Lines), have both proposed broad theories of inequality as the root cause of economic crisis.

In an article that focuses on more specific causal mechanisms, Englebert Stockhammer proposes a post-Keynesian model that interprets the Great Recession as a result of interactions between economic inequality and the effects of financial deregulation. According to Stockhammer, a variety of microeconomic studies have explored the effects of financial deregulation, but the former dimension–economic inequality–remains woefully neglected in the literature. (Of course, there was this big study from the ILO, but it is still organized primarily around the Rajan hypothesis.)

In saying that Stockhammer is a post-Keynesian, this means that his conception of the economy at a macro-level derives from the work of Polish macro-economist Michal Kalecki by way of Bhaduri and Marglin. As I understand it, this school of thought allows for aggregate demand to be either “wage-led” or “profit-led.” In a wage-led demand regime, higher wages led to higher aggregate demand, and consumption is more important than investment and net exports in driving economic growth. In a profit-led regime, on the other hand, an increase in wages has a negative effect on demand, and investment is the key economic accelerator. Stockhammer, and other post-Keynesians, see Capitalist economies as wage-led.

Applying all this to the Great Recession, Stockhammer argues that rising inequality has led to stagnating demand from consumers, an increase in household debt, and increased propensity for financial institutions to engage in speculative investments. The story is familiar by now: low wage growth forced households to borrow more to take out mortgages to maintain their standard of living, encouraged by predatory lending practices even to “subprime” candidates. Eventually, the debt payments could no longer be realized due to stagnant wages and housing prices, and the market collapsed.

The model makes sense for explaining crises like those faced by the US in the Great Depression and the Great Recession. But what about the crisis in Greece, which, according to this study, was actually one of the only countries to experience a small decline in the Gini coefficient since the mid 80s? Or the “stagflation” crisis that plagued the global economy in the late 1970s, when rising inflation was not coupled with economic growth, but instead massive unemployment? Indeed, it was the latter crisis that caused the theories of Keynes to lose currency in the first place, and forced economists to focus on exogenous effects on production costs (eg. oil shocks) and monetary policy.

In an excellent Marxian analysis of Stockhammer on his blog, Michael Roberts points out that the very title of Stockhammer’s paper, “Rising inequality as a cause of the present crisis,” implies that his model is not valid for all crises at all times. Indeed, the post-Keynsians would likely argue that, while the Capitalist economies were profit-led in the 1970s, they are now wage-led. But Stockhammer’s association of the present crisis with the Great Depression would seem to imply that Capitalist economies were wage-led at that time as well. This leads us to an important question: how did Capitalist economies go from being wage-led in the 1930s, to profit-led in the 1970s, and back to wage-led in the 2000s?

Marxian Analysis and the “Law of the Tendency of Profits to Fall”

Attempting to answer this question forces us to look at questions of history, how capital accumulates over time, and what the macro-economic implications of this circulation and accumulation may be. Marx takes an approach to analyzing Capitalism that is at times elusive, but, following David Harvey, I believe this is largely due to his efforts to grasp these aspects of capital.

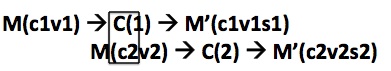

In Vol. 2 of Das Kapital, Marx models the economy as a “circuit of productive capital” between capital goods markets (for commodities used in the production process, which I denote (1)) and consumer goods markets (2). The circuit begins in when the capitalist in (1) spends money (M) to acquire constant capital (c1) and variable capital (v1). These factors are combined to produce a commodity for the capital goods market (C(1)). Thus, the first moment: M(c1v1) –> C(1).

The commodity is sold at a profit, realizing a surplus value (s1) for the capitalist in (1). The original capital M only enters into circulation based on the promise of s1, which cannot be realized until the commodity enters the market. Thus, the second moment: M(c1v1) –> C(1) –> M'(c1v1s1)

It is clear that s1 is exogenous to the system and can only be added through the purchase of C(1) by another capitalist. For the capitalist in the consumer goods market (2), the commodity purchased in the capital goods market becomes the constant capital (c2) to be employed in the production process. This is combined with variable capital (v2) in the production process to produce a commodity for the consumer goods market (C(2)). Thus the third moment: M(c2v2) –> C(2).

The commodity is again sold by the capitalist at a profit, realizing surplus value (s2). Thus the fourth moment: M(c2v2) –> C(2) –> M'(c2v2s2)

Once again, we see that s2 is exogenous to the system, and must be added through consumption on the market (2). Consumption in both (1) and (2) carries the promise of reproduction: (1) is a circuit for the reproduction of capital, while (2) is a circuit for the reproduction of capitalists as physical subjects. Consumption in (1) also carries the promise of the realization of surplus value. This explains the origin of s1 as exogenous value in the system. The relationship of consumption in (2) to the future realization of surplus value is much less obvious.

This begs the question, from where does this exogenous value originate? The answer points us to the interaction of multiple circuits of productive capital, and in particular to the role of credit in the capitalist economy. Credit arises from the fact that constant capital does not realize its full value in one production cycle, but over the lifetime of the capital good. In order to cover the costs of constant capital, the capitalist takes out a loan with interest, based on the promise that surplus value will be realized in the production process.

But the very possibility of this loan is dependent on some other capitalist having realized a significant enough surplus value that he/she is able to employ it in other circuits of productive capital. In this way, credit functions as a bridge between the surplus value of yesterday and the realization of tomorrow.

In analyzing multiple opportunities to employ surplus value, be it through financing or re-investment in the production process, capitalists focus on the rate of profitability (r), which, if we speak in terms of our original model of the circuit of productive capital, can be expressed as: r = M’-M/M or s1/M(c1v1).

This expression of rate of return implies that capitalists evaluate investment opportunities based on surplus value; the higher the number on top, the greater the rate of profitability and the more attractive the investment. Capitalists looking to attract investment will therefore work to maximize surplus value.

There are two fundamentally different ways to do this. The capitalist can reinvest profits into the production process by buying more technology (constant capital c) and hiring more workers (variable capital v). However, if we recall our formula for the rate of profitability (r = s1/M(c1v1)), we can see that further investments of this sort have a tendency to decrease the rate of profitability.

This is what Marx calls, in vol. 3, the “law of the tendency of the rate of profitability to fall.” It has been a very controversial proposal of Marx’s, and intuitively, it just seems wrong. The rate of profitability of capitalist economies have not fallen over time, but on the whole, have increased greatly. However, Marx’s model is of a closed system, and does not take into account exogenous shocks like the introduction of new labor-saving technologies or discoveries of natural resources. Furthermore, it is a long-term assessment, and we can posit something like an S-curve for the relationship between investment in production and the rate of profitability.

So while re-investment in the production process is one way to increase surplus value, ultimately it comes up against the limit of diminishing marginal returns. This forces the capitalist to look for other ways of increasing surplus value without also increasing her/his initial investment in the production process (M). This is where exploitation comes in, as the capitalist finds a way to claim more surplus value from the worker’s labor-time. Marx provides numerous historical case studies of attempts to negotiate this exploitation, especially in the factory culture of 19th century England.

Marxian Analysis of Economic Crisis

All of this helps us answer the question posed to the post-Keynesians that ended section 1: how did the US economy go from being “profit-led” in the 1970s, to “wage-led” in the 2010s? Again, we can turn to Roberts’ response to Stockhammer. The immediate cause of this transition was that wage growth stagnated while profits rose.

But why did this happen? According to Roberts, it was due to a rise in the “rate of exploitation as a counteracting factor to the fall in profitability.” As increased oil costs and high wage and tax rates raised the costs of production, capitalists responded through layoffs, the destruction of labor unions and worker’s rights, privatization of state assets, de-regulating product markets and industry, reducing corporate taxes, and the rest of the economic program that refer to as “neo-liberalism.” Inequality, then, is really a symptom of the drive to expand surplus value.

The Marxian approach critiques the very premise of our question. According to Marx, Stockhammer and other post-Keynesians are guilty of isolating aggregate demand from the other moments of the circuit of productive capital. So they are constantly stuck explaining crises post-facto. The Marxian approach sees crisis as a systemic factor of capitalism, resulting from the structural limits to the rate of production of surplus value. History, then, is the story of capitalists overcoming these limits through further and further innovation and exploitation.

In a future post, I hope to explore some of the policy implications of this. Post-Keynesians like the authors of this recent IMF paper would have us undertake wealth redistribution to solve for inequality and create sustainable growth. According to Marxian political economy, this is a band-aid solution that will ultimately not stave off crisis. The only solution, it seems to me, is find a way to change the engine of capital reproduction from ever-growing surplus value. The question of how to do that is much more difficult to answer.